Steve Clark's Professional Portfolio

Steve Clark's Professional Portfolio

A Better Bond Buying Experience

Helping investment firms increase assets under management by offering an easier way to buy U.S. Treasuries

Background

Online securities trading has primarily been limited to stocks, options and ETFs. Bonds are a valuable hedge for active investors, however, the purchasing experience is still very rudimentary.

AUM (assets under management) is a key metric for traditional investment firms and online brokers, alike. A better bond-trading experience could encourage day traders and self-directed investors to keep more of their holdings with their trading platform.

United States Treasury securities are among the most stable investments in the world, offering fixed, guaranteed returns. Bonds are generally difficult for online traders, however active investors could benefit from Treasuries if there were a more logical way to transact.

Competitive Analysis

Every U.S. Treasury buying experience is confusing. Investors need to know what they are doing and what to look for when purchasing Treasury Bonds, Bills and Notes. In most cases the necessary information is buried deep in the experience. Information is monolithic; the most important data points are as prominent as the least important.

Assumptions

These new user journeys are based on the following assumptions stemming from our competitive research:

- Investors will browse Treasuries with the intention of buying; Investors looking to sell Treasuries will originate from their respective portfolios.

- Since Treasuries have a guaranteed return there is no risk tradeoff. Investors will always pick the highest yields; the variables are Maturity Date and Minimum Investment.

- Treasury type (Bond, Bill, Note) is low priority.

- Investors avoid transacting on mobile devices because it’s overwhelming

The hypothesis is simple: A better U.S. Treasury purchasing experience will result in more investors holding these stable securities thus leading to an increase in assets under management for our client.

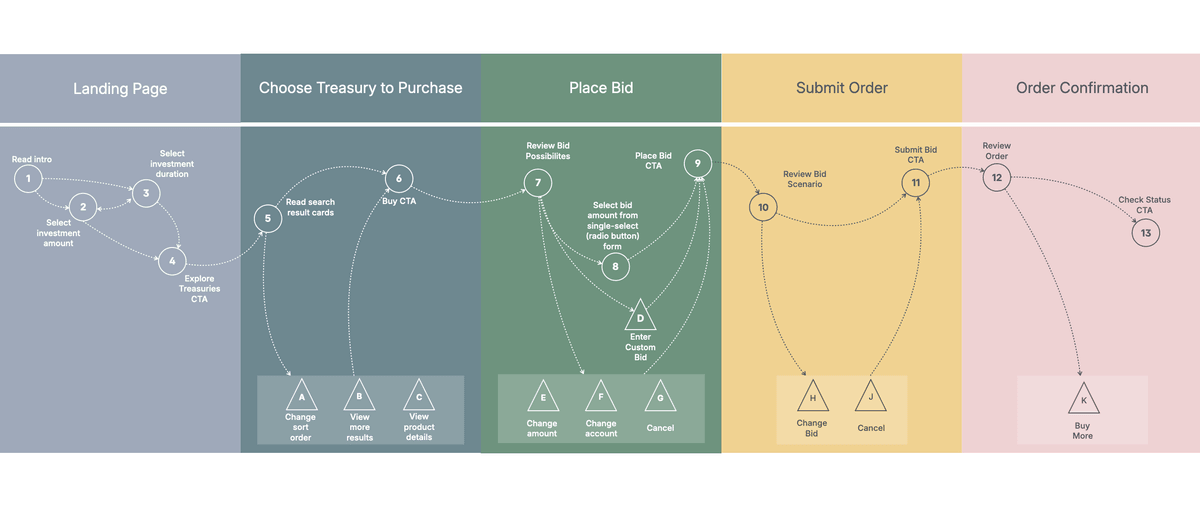

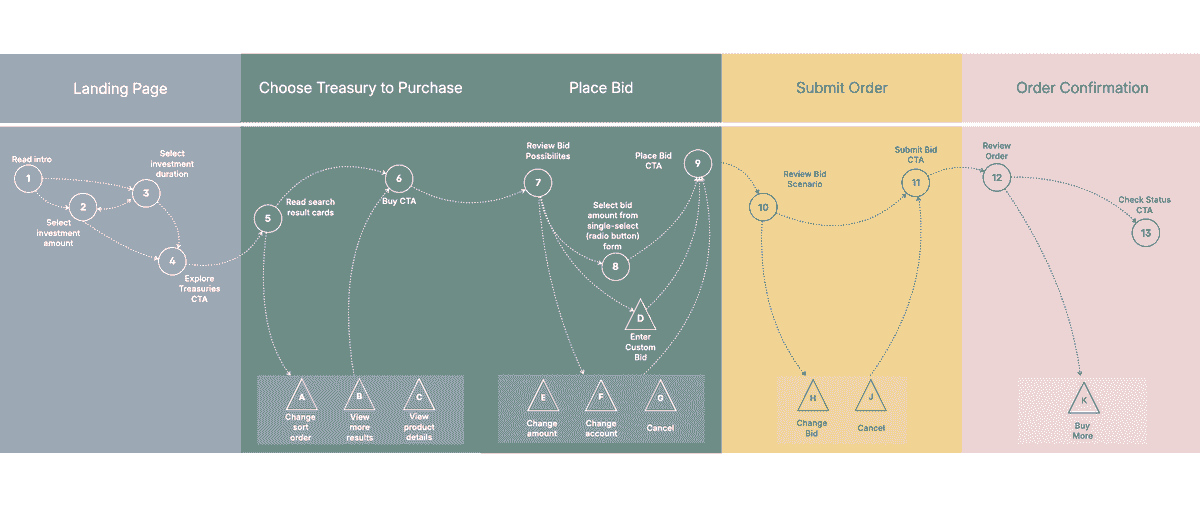

A New Investor Journey

Journey Map

Primary Flows

Landing Page

1. Read Introduction

2. Select Investment Amount

3. Select Investment Duration

4. Explore Treasuries Call to Action

Choose Treasury to Purchase

5. Read Search Results Card

6. Buy

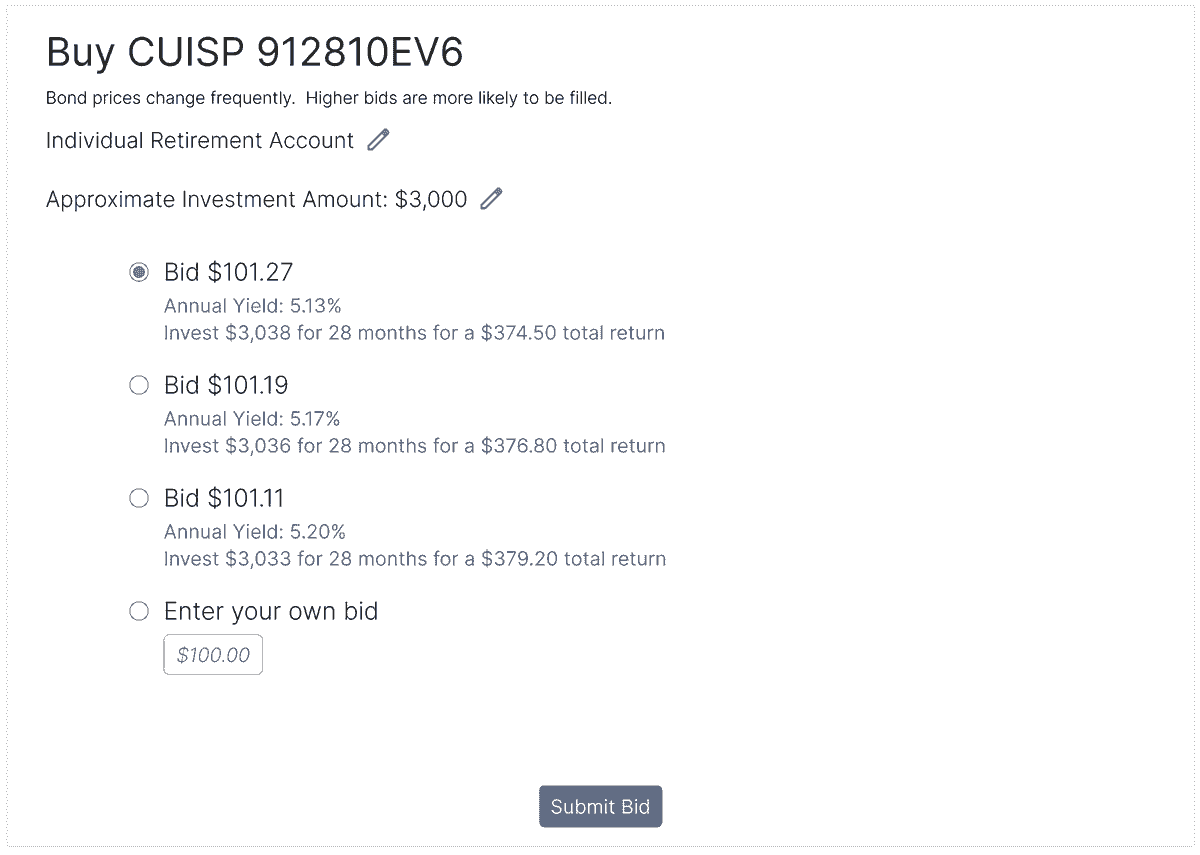

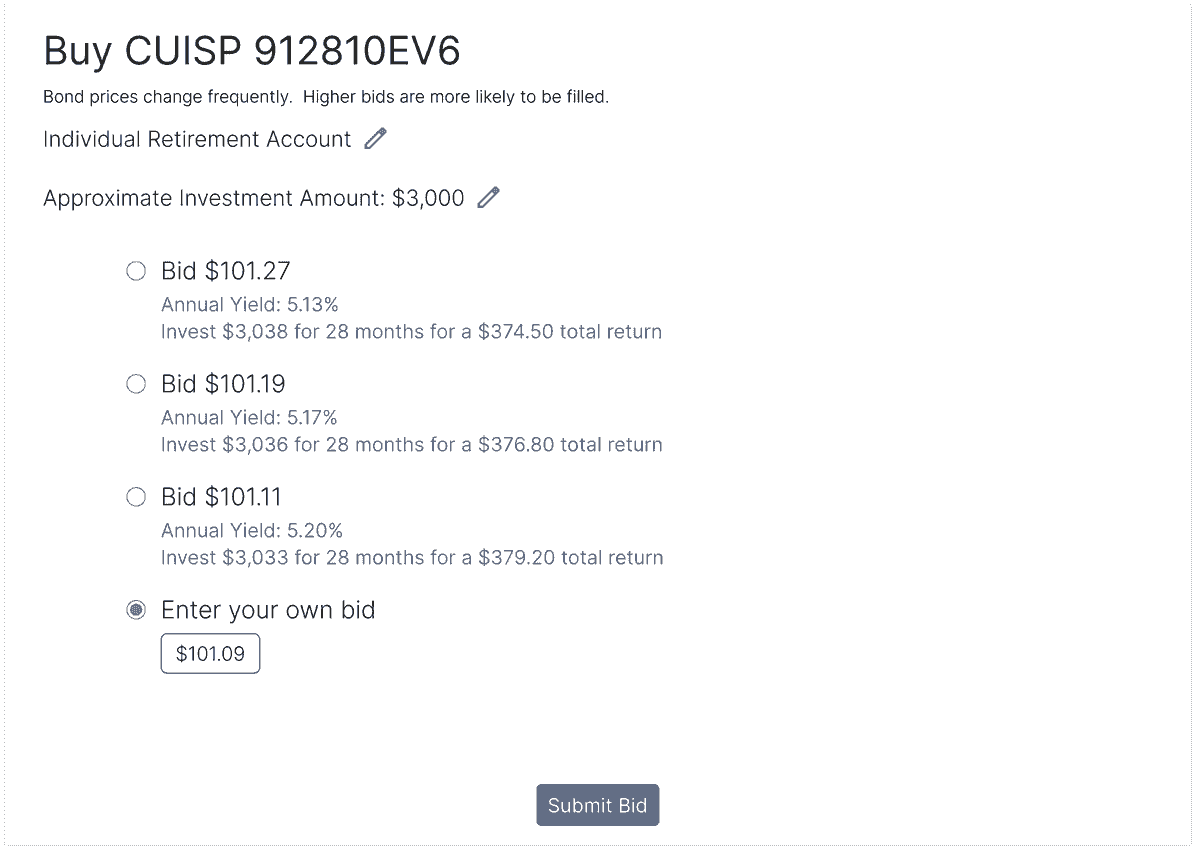

Place Bid

7. Review Bid Possibilities

8. Select Bid Amount

9. Place Bid

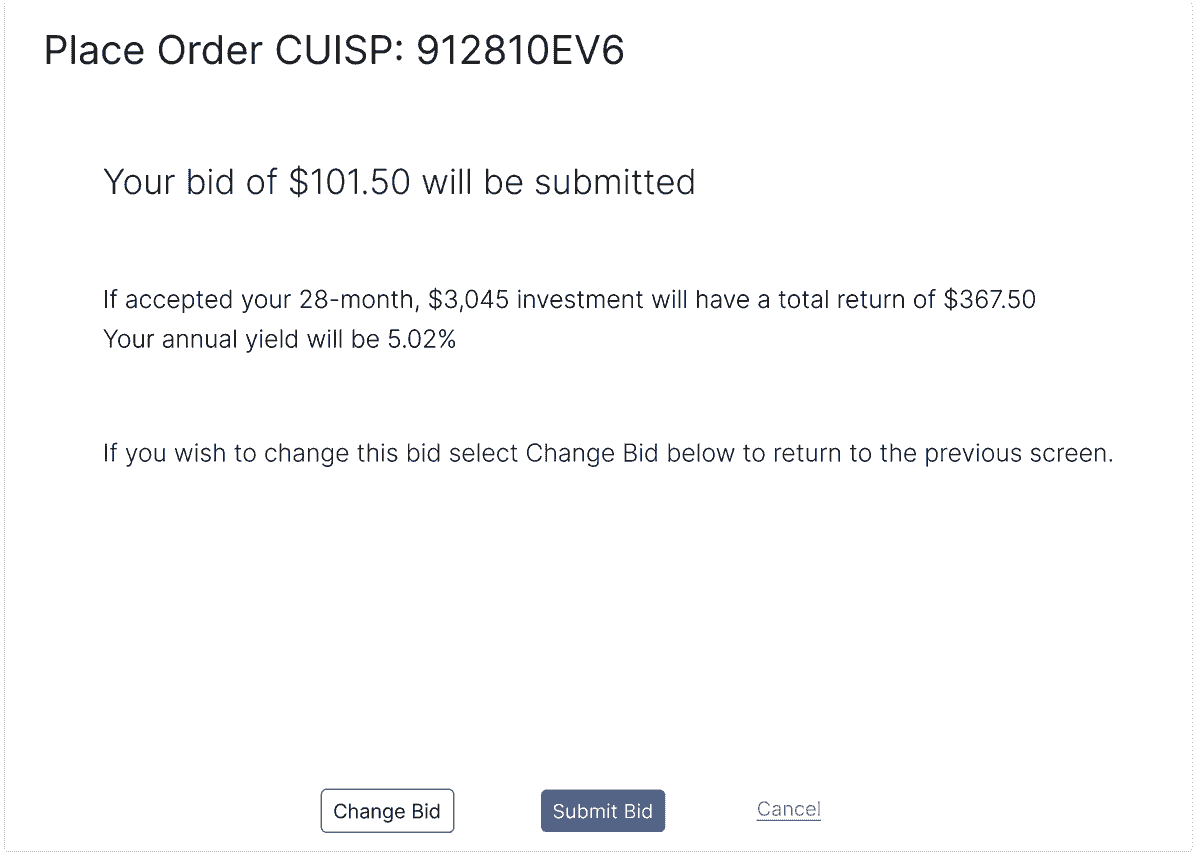

Submit Order

10. Review Bid Scenario

11. Submit Bid

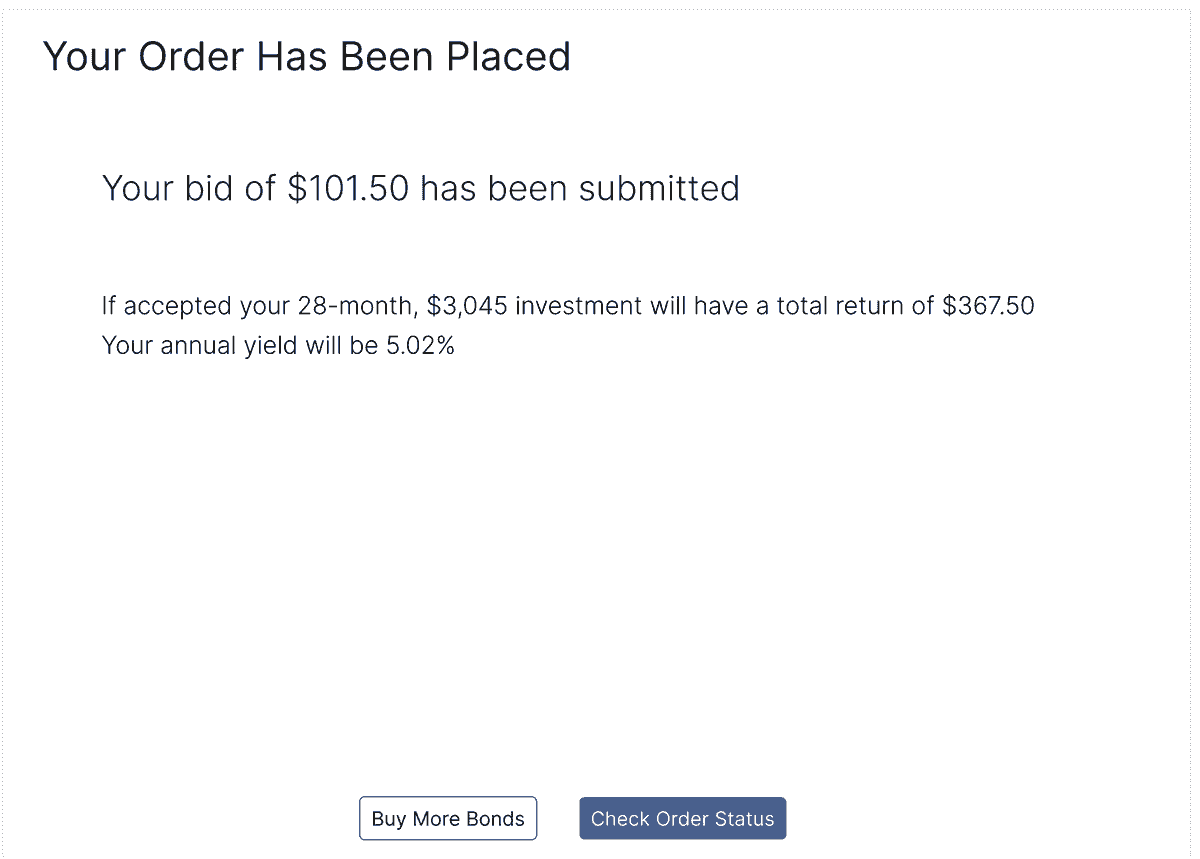

Order Confirmation

12. Review Order

13. Check Order Status

Wireframes

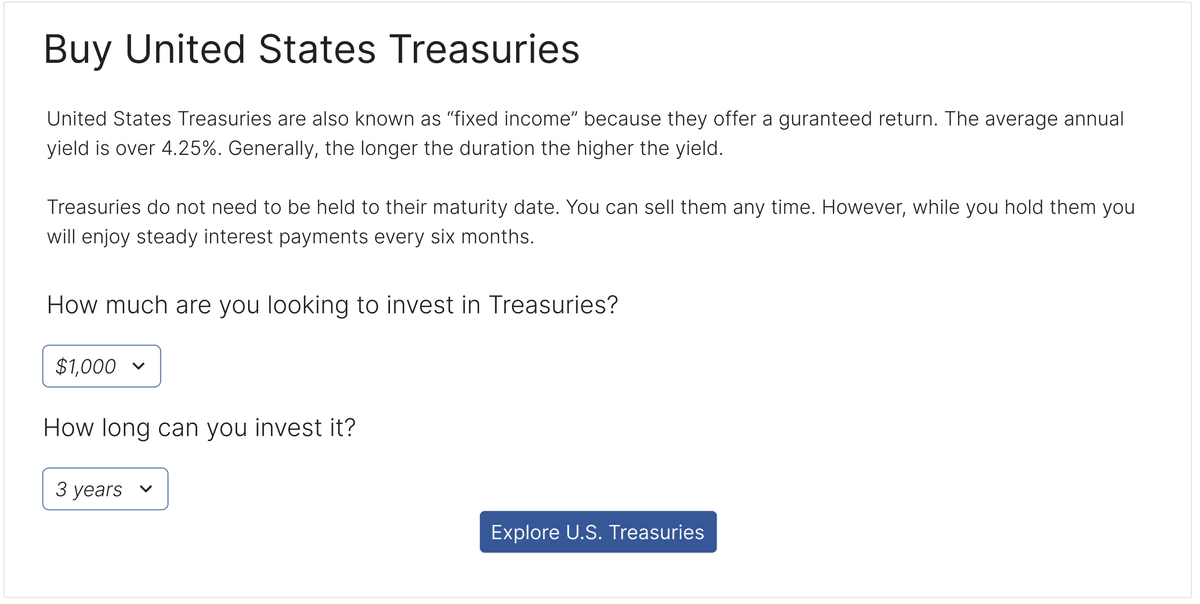

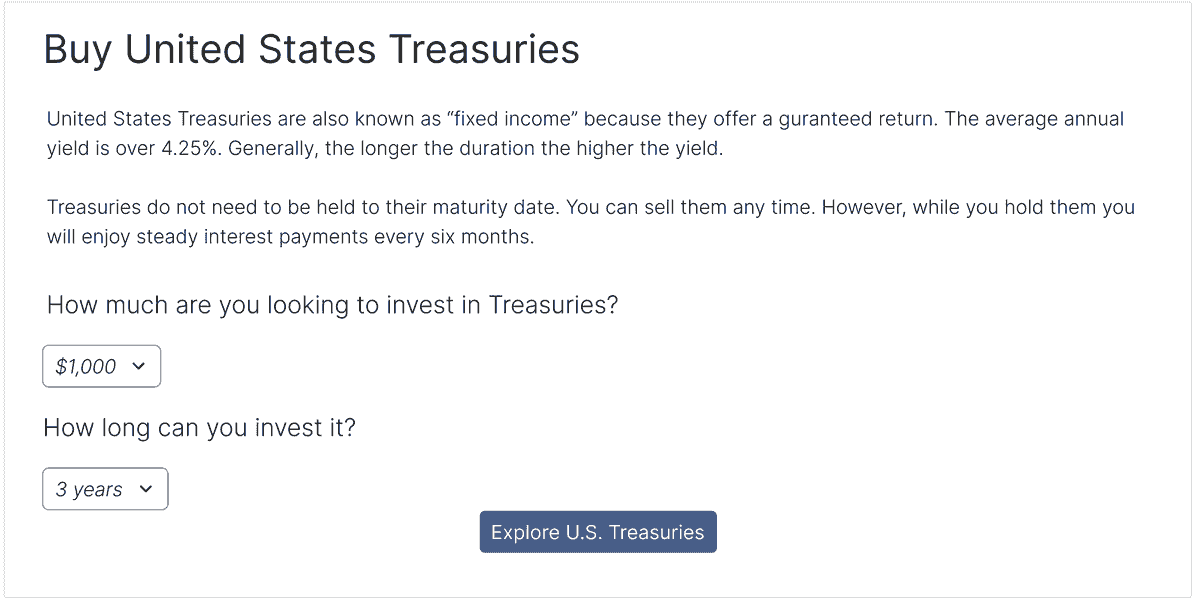

Investors start the journey when landing on the "Buy United States Treasuries" screen. Here they are given an overview of Treasuries and are asked two questions:

- How much are in investing?

- How long are you investing?

These two answers will quickly determine the best available options.

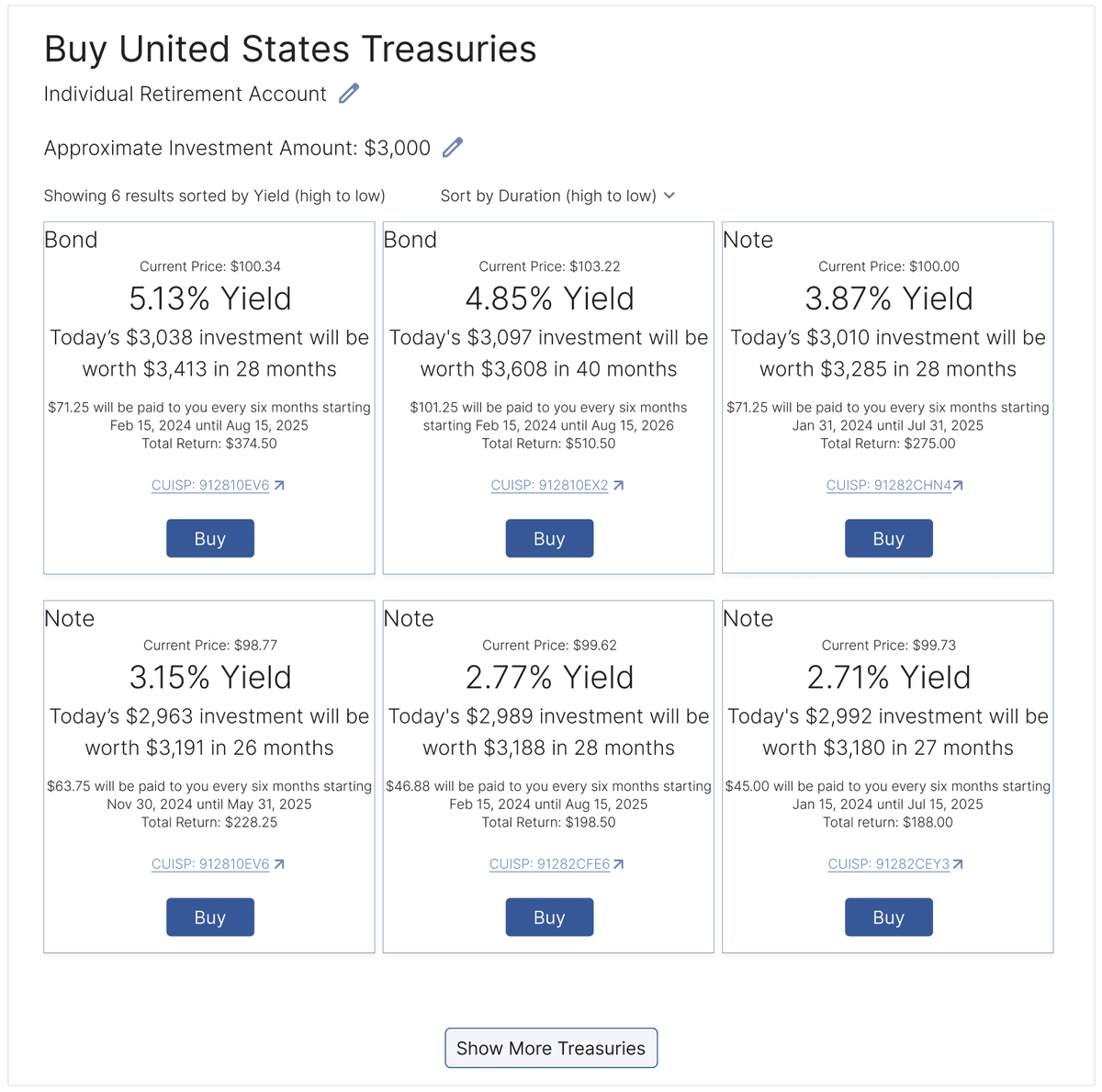

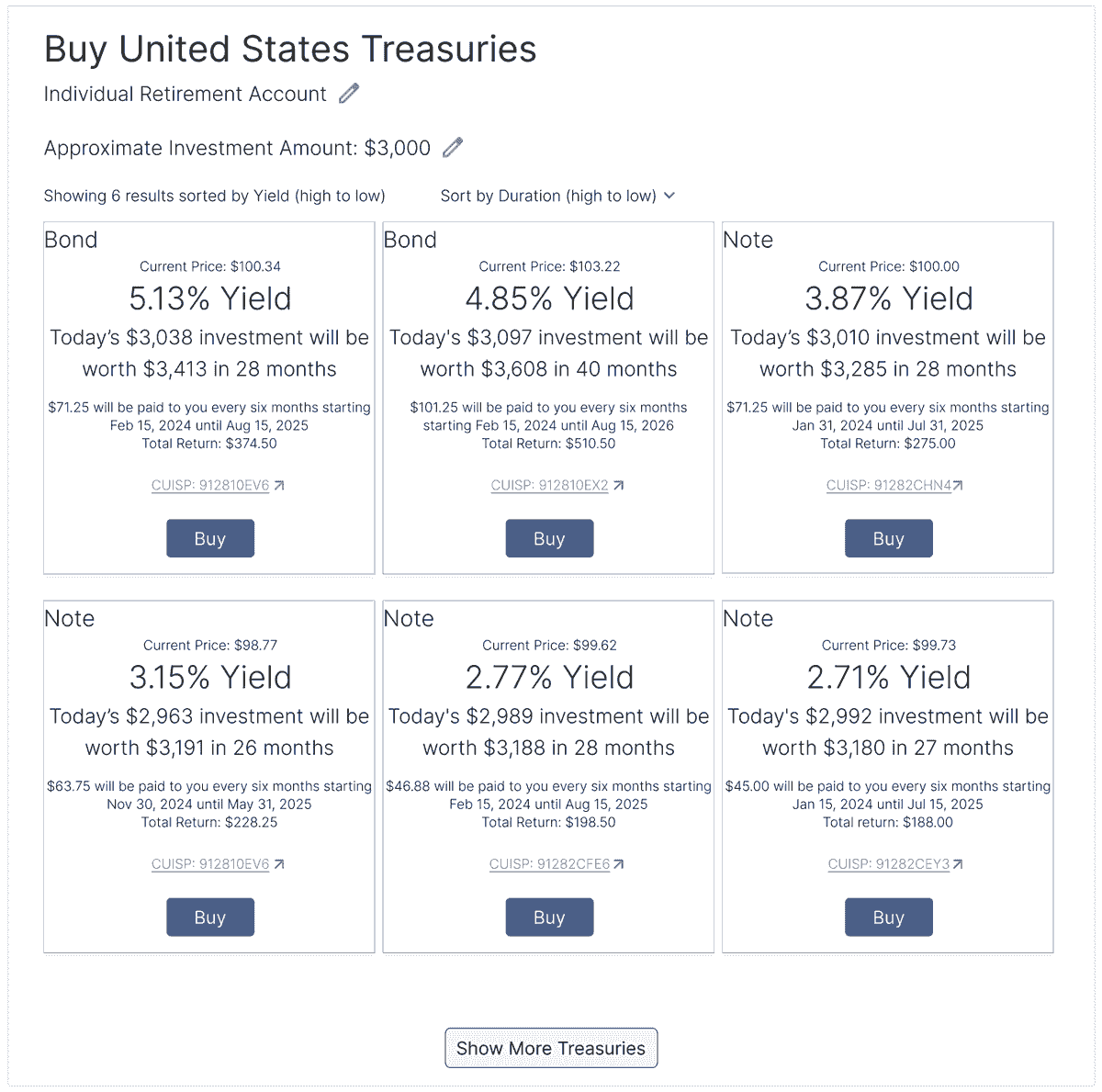

Select Treasury Product

Once investors provide their preferences we can return a set of best-fit options. At this point most Treasury purchase flows simply present a table of matching items (and some that do not). Here we are showing the most relevant information. Yield, which in bond trading is the annual return on investment, is the most prominent. Results are sorted by yield, highest to lowest.

Next we explain what the investor can expect if these bonds were purchased today. In our example the investor was looking to invest around $3,000 so we calculated how much would would be spent. Since Treasuries sometimes sell for a premium, we can expect to pay slightly more for a good yield. In this example the 5.13% yield is selling for $101.27 (current price). Treasuries selling below $100 are referred to as Discounted whereas those selling for over $100 are called Premium.

The Treasury's CUISP, which is its unique identifier, is presented after the Buy button.

We will choose the highest yield Treasury. As we navigate to the next screen our selected card has focus and the Buy button has a hover and selected state.

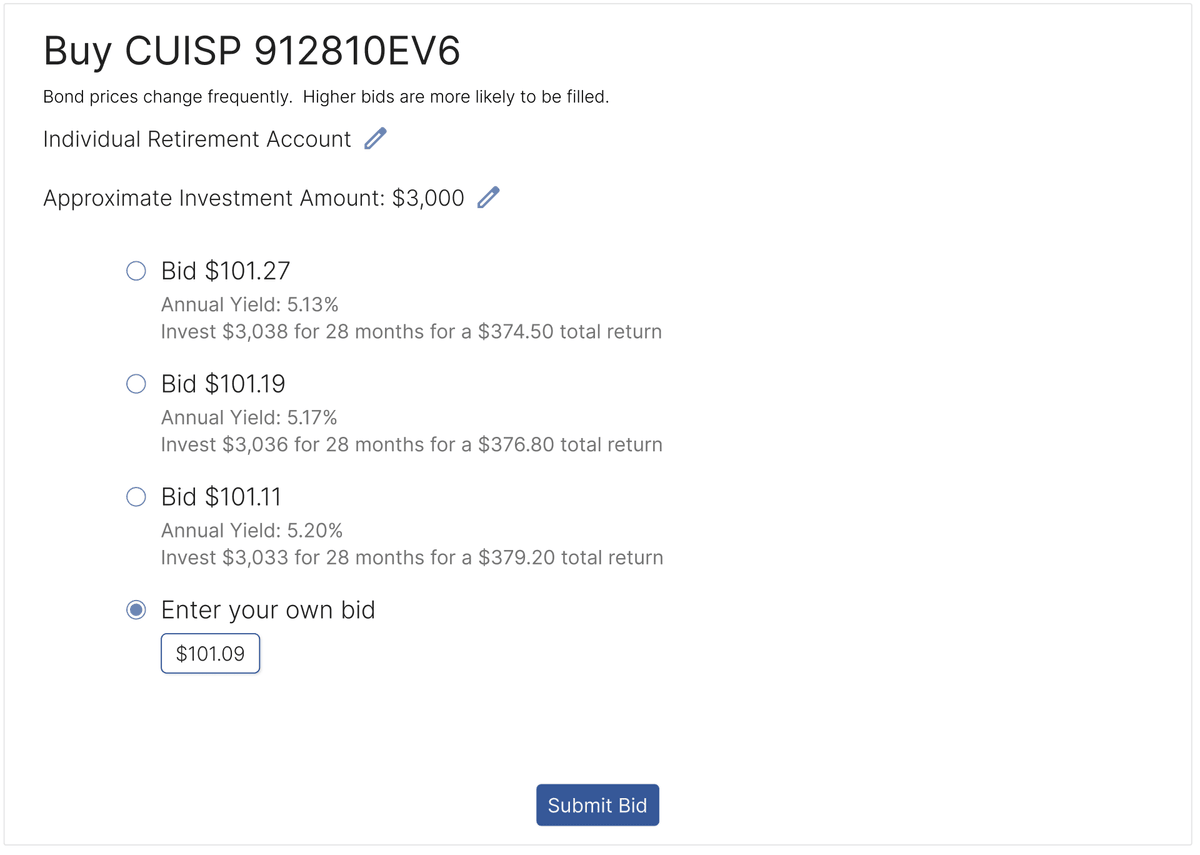

Bid on Selected Treasury

Investors are required to bid on Treasuries. Here we simplify the bidding process by informing investors that highest bids are likely to be filled. This page details the highest, lowest and average current bid. It explains the expectations of each, and in most cases the difference between the high bid and the low bid is very small. In this case the differences between the total investments and annual yields are $5.00 and 0.07%, respectively.

Current Treasury purchasing experiences do not do this.

Prior to placing the bid, investors can change the approximate investment amount, in this case $3,000, and the account into which they are purchasing the Treasury security.

Investors can also provide their own bids. For this example we will do exactly that. Again, the darker CTA indicates the hover and selected state, meaning we will be proceeding to the next page.

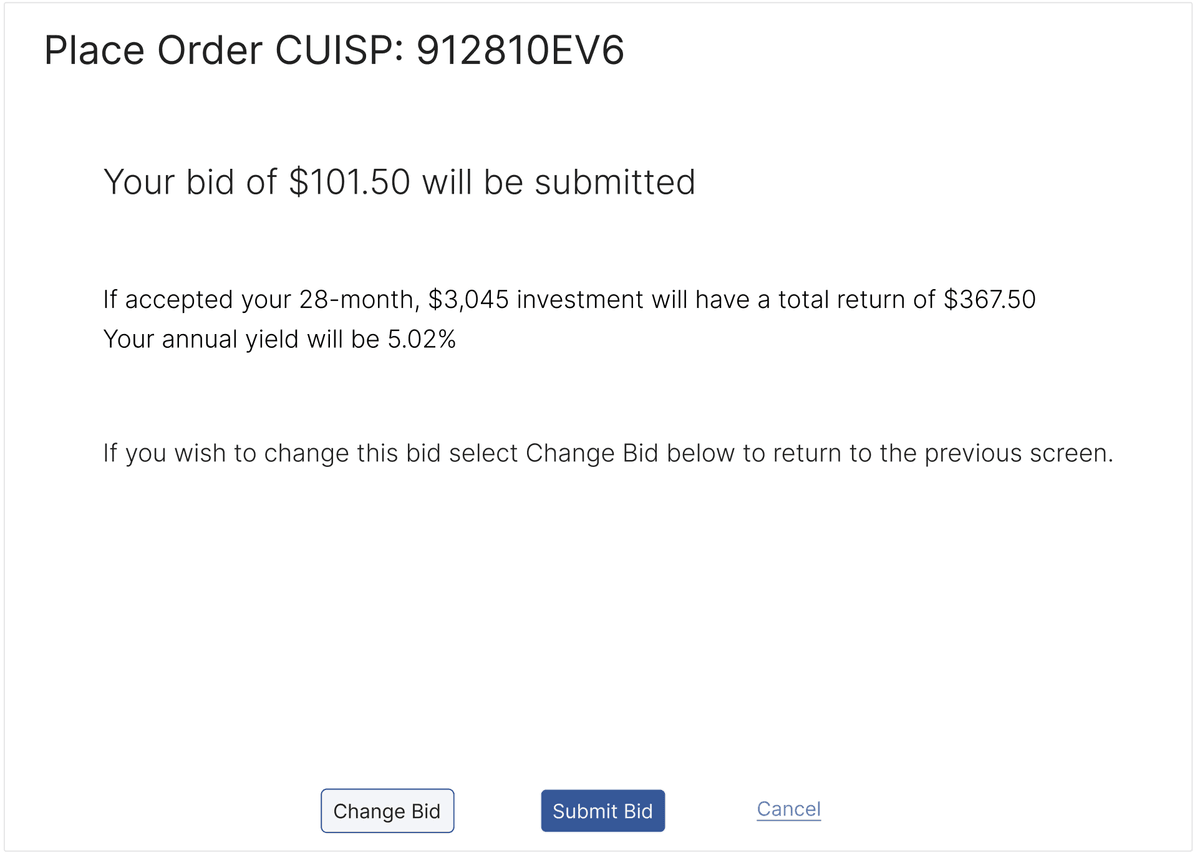

Place Order

We have chosen our bid amount, now it is time to submit the order. We continue to provide clear expectations to our investors. They are informed of how much they will be investing, their total return and annual yield.

In addition to submitted the bid, investors can change bids or cancel.

Order Confirmation

With any transactional experience an order confirmation screen is presented. Investors are accustomed to having to check the status of their orders, therefore a Check Order Status option is presented. Similarly, since this transaction was for a bond, we offer the Buy More Bonds option.

Steve Clark

Full-Stack Product Manager/Web Application Design Architect

t3xt me at fore zero ate dash five six nine dash won seven six zero

in other words

00000100 00000000 00001000 00000101 00000110 00001001 00000001 00000111 00000110 00000000